By Luis Meiners – International Socialist League, USA

This Monday, March 9, the New York Stock Exchange opened with a sharp drop that triggered a “circuit – breaker” halting operations for 15 minutes. At the end of the day, the Dow Jones, which reflects the top 30 industrial companies, had its biggest setback since October 15, 2008. Market analysts have pointed to a combination of the coronavirus effect and the fall in the price of oil following production disagreements between Saudi Arabia-led OPEC and Russia. But the roots of what might be the beginning of a new recession should be sought in the structural trends of the U.S. economy and the world.

The triggers

The number of people infected with the coronavirus already exceeds 114 thousand in 112 countries, recording more than 4,000 deaths. Quarantine measures and travel restrictions have had a real effect on the economy, hitting distribution and production chains, tourism and transportation industries.

After reaching historically high values, over the past few weeks the major Wall Street benchmarks began to fall. The S&P 500 fell 12% in the 12 days leading up to this Monday. The half point reduction in the FED interest rate announced on Tuesday, March 3, was not enough to contain the fall. Both the FED and major market analysts attributed the fall to the coronavirus.

Added to this, the price of oil suffered its sharpest fall in a day since 1991, reaching its lowest value of the last four years. Russia’s refusal to reduce its production provoked a response from Saudi Arabia by sharply cutting its selling prices. The fall in the price of the barrel, to an approximate $30 mark, hits the shale industry hard in the United States, as it needs a prices above $50 to make a profit. This generated heavy losses in the stock values of oil companies.

Structural elements

These phenomena, while exerting a real effect, do not explain the overall dynamics of the situation. This requires a deeper look at the structural elements of the capitalist economy in order to understand its crises. Without seeking to carry out a thorough analysis of them, which exceeds the purpose of this writing, it is essential to point them out in order to understand how they interact with the specific aspects of the present situation. Analyzing from a Marxist perspective, the key element to understand capitalist crises is the tendency of rates of profit to fall. Michael Roberts, among others, has demonstrated how this can be historically verified and is critical to explaining the recurring crises of capitalism. In a recent article he notes, “Over decades, there has been a secular decline in the profitability of capital across all the major economies – if you like, the world rate of profit has fallen – but not in a straight line, because there have been periods where the counteracting factors to the tendency have been stronger. But over the history of modern capitalism, the rate of profit has fallen. Marx’s law is not only secular (namely a long-term tendency for profitability to fall). The law also helps explain the cyclical recurrence of booms and slumps in capitalist production and investment. The operation of counter-tendencies transforms the breakdown into a temporary crisis, so that the accumulation process is not something continuous, but takes the form of periodic cycles.

Figure 1. Declining profit rates. Source: Michael Roberts: Marx’s law of profitability at SOAS.

Just over a decade separates us from the last great crisis. In these years, capital overaccumulation has deepened. With declining returns, incentives for productive investment are lower and capitalists turn to financial speculation in search of profits. This, in turn, generates a bubble that develops in the sphere of speculative fictitious capital.

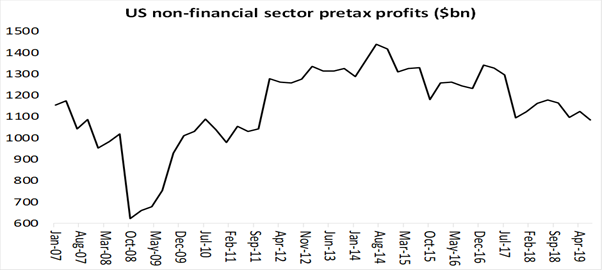

As can be seen in Figure2, the profits (pre – taxes) of the US non-financial sector have fallen since 2014.

Figure 2. US non-financial sector pretax profits ($bn). Source: US BEA NIPA Tables quoted in Michael Roberts, Trump’s trickle dries down.

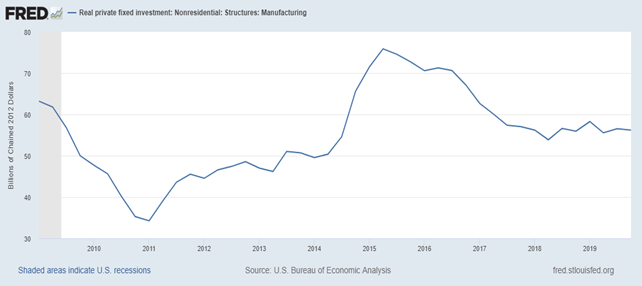

This leads to a drop in productive investment. One of the main components of GDP growth is private investment in constant capital, i.e. the purchase of structures, equipment, software, etc. in order to expand production capacity. Figure 3 shows the drop in that investment in the US after 2014, in line with the declining profits seen in Figure 2. The same is true if we compare both charts for the previous crisis. The fall in profits in the second half of 2008 is followed by a sharp drop in investment in 2009. The available data does not yet reflect what has happened in the last quarter of 2019 and the beginning of 2020, but everything seems to indicate that the fall has deepened.

Figure 3. Real private fixed investment. Nonresidential. Manufacturing. 2009 – 2019. Source: FRED Economic Data

Despite these indicators of a slowdown in the real economy, the speculative bubble continued to grow. In this scenario, the emergence of factors such as coronavirus and falling oil prices act as a catalyst for contradictions that had been accumulating. Investors sense it’s time to sell which translates into a sharp stock market crash, like the one that occurred on Monday. This, in turn, will have a negative impact on the real economy. Thus, the scenario of the US economy approaching recession seems more likely.

Specificity of the current crisis

Marx argued that capital only overcomes its crises by laying the groundwork for an even greater crisis. Thus, we must look at the ways in which governments and capital tried to overcome the 2008 crisis to analyze the dynamics of the crisis that may have already begun to unveil. The US state’s response to the 2008 crisis has revolved around monetary policy. They focused on increasing the supply of money under the assumption that this would increase economic activity. In simple terms, transfer money obtained from the working class (taxes) to big business and banks for them to lend and invest under the promise that the benefits generated by increased economic activity would “trickle down”.

One of the first responses from governments to the outbreak was quantitative easing. It consisted essentially of feeding money to the market by purchasing financial assets through the Federal Reserve. That’s how the state, under the Obama administration, intervened massively in the economy to bail out the banks and Wall Street.

This was accompanied by a sharp reduction in interest rate by the FED. The goal, again, was to increase the supply of money, in this by cheap money readily available for credit. The low interest rate has become the norm since the 2008 crisis, even after increases starting in 2016.

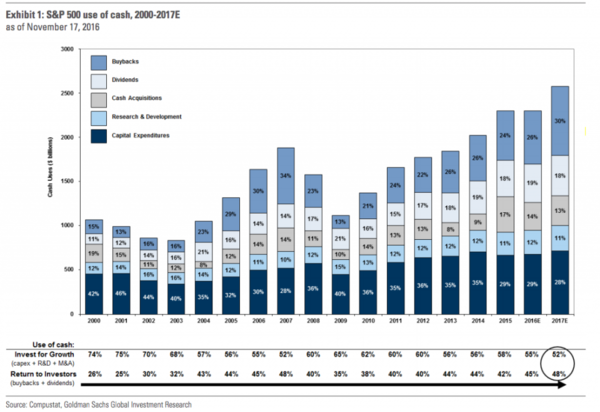

Unsurprisingly, however, the rich used this money to become richer. In the face of modest prospects for profit in productive activity, they turned massively to speculation. Figure 4 shows the evolution in use of cash among S&P500 companies. Spending on capital expenditures fell from 42% in 2000 to 28% in 2017. In the same period expenditures on returns to investors through buybacks and dividends grew from 26% to 48%.

Figure 4. S&P 500 use of cash, 2000 – 2017. Quoted in Toussaint, Eric: The mountain private debts will be at the heart of the next financial crisis.

A third element to “stimulate” the economy after 2008 were the huge tax cuts to the rich under Donald Trump’s administration. Through the “Tax Cuts and Jobs Act”, passed in December 2017, corporate taxes were reduced from 35% to 21%. But, productive investment with its multiplying effect on the economy never came. A study published by the IMF in 2019 shows that less than 20% of the extra income obtained from the tax cuts was used in capital investment, while about 80% was used to buyback their own shares (in order to push share prices up) and for shareholder dividends. A consequence that did in fact come was the increase in inequality. A US Congressional study that measures the projected effect of tax cuts on incomes for the period 2016 – 2021 concludes that they will produce a 0.2% drop in the incomes of the poorest 20%, while the richest 1% will see their income increase 0.9%.[1][2]

The increase in money supply and it´s use to feed speculation ultimately produced one of the central elements of the fragility of the current configuration of the economy: the huge stockpile of corporate debt. The stock market’s downturn can strongly affect the ability of these companies to pay, unleashing a wave of repercussions for both the companies themselves and their creditors. In this way, the possibility of a recession was fueled.

In a recent

article Eric Toussaint states that “All the ingredients for a new financial crisis

have been present for several years, at least since 2017-2018. When the air is

replete with inflammable materials, any given spark can cause a financial

explosion, at any time.[3] We are probably living the first moments

of a new crisis and recession. When it unfolds, it is essential not to lose

sight of its causes, so that those responsible cannot continue to accumulate

hidden behind a virus or the price of the barrel of oil.

[1] Roberts, Michael: Marx’s law of profitability at SOAS. Disponible en https://thenextrecession.wordpress.com/2020/02/27/marxs-law-of-profitability-at-soas/

[2] IMF Working Paper, U.S. Investment Since the Tax Cuts and Jobs Act of 2017, disponible en https://www.imf.org/en/Publications/WP/Issues/2019/05/31/U-S-46942

[3] Congress of the United States, Congressional Budget Office, Proyected Change in the distribiution of household income. Diciembre 2019, disponible en https://www.cbo.gov/system/files/2019-12/55941-CBO-Household-Income.pdf

[4] Toussaint, Eric. No, el coronavirus no es el responsable de las caídas en las bolsas. Disponible en https://www.cadtm.org/No-el-coronavirus-no-es-responsable-de-las-caidas-en-las-bolsas