Por Luis Meiners, LIS Estados Unidos

Este lunes 9 de marzo la bolsa de Nueva York abrió con una fuerte caída que obligó a detener las operaciones durante 15 minutos. El Dow Jones, que refleja a las 30 compañías industriales más importantes, tuvo su mayor retroceso desde el 15 de octubre de 2008. Los analistas del sistema apuntan a una combinación del efecto coronavirus y la caída del precio del petróleo tras los desacuerdos sobre la producción entre al OPEP, liderada por Arabia Saudita, y Rusia. Sin embargo, las raíces de lo que podría ser el comienzo de una nueva recesión deben buscarse en las tendencias estructurales de la economía de Estados Unidos y el mundo.

Los disparadores

El número de personas infectadas por el coronavirus ya supera las 114 mil en 112 países y se registran mas de 4 mil muertes. Las medidas de cuarentena y restricciones de viaje han tenido un efecto real sobre la economía, golpeando sobre cadenas de distribución y producción, sobre la industria turística y del transporte.

Luego de alcanzar valores históricamente altos, durante las últimas semanas los principales índices de referencia de Wall Street empezaron a caer. El S&P 500 cayó 12% en los 12 días previos a este lunes. La reducción de la tasa de interés de la FED por medio punto anunciadas el martes 3 de marzo no fue suficiente para contener la caída. Tanto desde la FED como desde los principales analistas del mercado se atribuía la caída al efecto del coronavirus.

Tal vez te interese: 2020, Lo que viene en la economía mundial

Por otro lado, el precio del petróleo sufrió su más fuerte caída en un día desde 1991, llegando a sus valores más bajos de los últimos 4 años. El rechazo de Rusia a reducir su producción provocó una respuesta de Arabia Saudita recortando fuertemente sus precios de venta. La caída del precio del barril, quedando algunos dólares por encima de $30, golpea duramente a la industria del shale en Estados Unidos, que necesita un valor por encima de los $50 para obtener beneficios. Esto generó fuertes pérdidas en los valores de las acciones de estas empresas.

Elementos estructurales

Estos fenómenos, si bien ejercen un efecto real, no explican la dinámica general de la situación. Para ello es necesario indagar con mayor profundidad sobre los elementos estructurales de la economía capitalista para comprender sus crisis. Sin pretender realizar un análisis exhaustivo de los mismos, que excede el propósito de este escrito, es fundamental señalarlos para comprender como interactúan con los aspectos específicos de la situación presente.

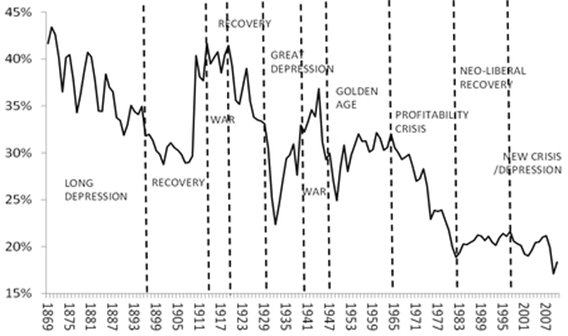

Desde el punto de vista de un análisis marxista, el elemento clave para analizar las crisis capitalistas es la caída tendencial de la tasa de ganancia. Michael Roberts, entre otros, ha demostrado como ésta puede verificarse históricamente y resulta fundamental para explicar las crisis recurrentes del capitalismo. En un artículo reciente señala, “A lo largo de décadas, ha habido una disminución secular en la rentabilidad del capital en todas las principales economías – si se quiere, la tasa mundial de ganancias ha caído – pero no en línea recta, porque ha habido períodos en los que los factores contraproducentes a la tendencia han sido más fuertes. Pero a lo largo de la historia del capitalismo moderno, la tasa de ganancias ha caído. La ley de Marx no sólo es secular (es decir, una tendencia a largo plazo a que caiga la rentabilidad). También ayuda a explicar la recurrencia cíclica de los auges y los desplomes de la producción y la inversión capitalistas. El funcionamiento de las contra – tendencias transforma la ruptura en una crisis temporal, de modo que el proceso de acumulación no es algo continuo, sino que adopta la forma de ciclos periódicos.”[1]El siguiente gráfico ilustra esta afirmación.

Gráfico 1. Caída Tendencial de Tasa de Ganancias. Fuente: Michael Roberts: Marx´s law of profitability at SOAS.

Poco más de una década nos separa de la última gran crisis. En estos años, la sobreacumulación de capital se ha profundizado. Con retornos decrecientes, los incentivos para la inversión productiva son menores y los capitalistas se vuelcan hacia la especulación financiera en busca de ganancias. Esto, su vez, genera una burbuja que se desarrolla en la esfera del capital ficticio especulativo.

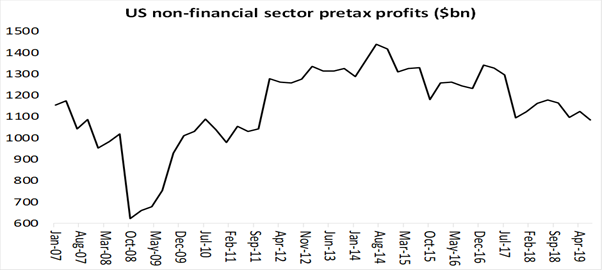

Como puede verse en el gráfico 2, las ganancias (pre – impuestos) del sector no financiero de EEUU vienen en caída desde el año 2014. Gráfico 2. Ganancias del sector no financiero de EEUU antes de impuestos, en miles millones de dólares. Fuente: US BEA NIPA Tables citado en Michael Roberts, Trump´s trickle dries down.

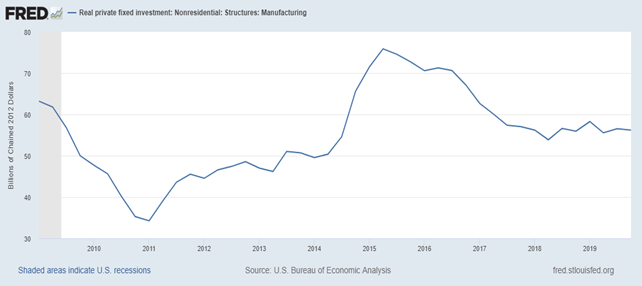

Esto genera una caída en la inversión productiva. Uno de los principales componentes del crecimiento del PBI es la inversión privada en capital constante, es decir, la compra de estructuras, equipamientos, software, etc. con la finalidad de expandir la capacidad productiva. El gráfico 3 muestra la caída de dicha inversión en EEUU luego de 2014, en coincidencia con lo visto en el gráfico 2. Lo mismo sucede si comparamos ambos gráficos para la crisis anterior. A la caída de las ganancias en el segundo semestre de 2008 le corresponde una fuerte caída en inversión en 2009. Los datos disponibles aun no reflejan lo sucedido el último trimestre de 2019 y comienzos del 2020, pero todo indicada que la caída de ha profundizado.

Gráfico 3. Inversión privada real en capital constante. Manufactura. 2009 – 2019. Fuente: FRED Economic Data

A pesar de estos indicadores de la economía real, la burbuja especulativa continuaba creciendo. En este escenario, la irrupción de factores como el coronavirus y la caída de los precios del petróleo actúa como catalizador de contradicciones profundas que se venían acumulando. Indican a los inversores que ha llegado el momento de vender, lo cual se traduce en una fuerte caída de la bolsa, como la que se produjo el lunes. Ésta, a su vez, tendrá un impacto negativo sobre la economía real. Así, todo parece indicar que la economía de EEUU se acerca a una recesión.

Especificidad de la crisis actual

Marx sostuvo que el capital solo supera sus crisis sentando las bases para una crisis aun superior. Así, debemos analizar las formas en que se buscó “superar” la crisis de 2008 para avisorar la dinámica de la crisis que quizás ya haya comenzado a desenvolverse. La respuesta del Estado de EEUU a la crisis del 2008 ha girado en torno a políticas monetarias. Estas se orientan por incrementar la oferta de dinero bajo el supuesto de que esto incrementará la actividad económica. Dicho de manera sencilla, poner dinero obtenido de bolsillos de los trabajadores (impuestos), en los bolsillos de los grandes bancos y empresas para que estas presten e inviertan.

Tal vez te interese: Ruidos de crisis en la economía mundial

Una de las primeras respuestas de los gobiernos ante el estallido fue la llamada flexibilización cuantitativa. Consistía esencialmente en alimentar de dinero al mercado comprando activos financieros a través de la Reserva Federal. Así fue como el estado, en la administración de Obama, intervino masivamente en la economía para salvar a la banca y a Wall Street.

Esto fue acompañado de una fuerte reducción de la tasa de interés de la FED. El objetivo, nuevamente, es incrementar la oferta de dinero, en este caso abaratando el crédito. La baja tasa de intereses se volvió la norma desde la crisis de 2008, aun a pesar de incrementos posteriores a 2016.

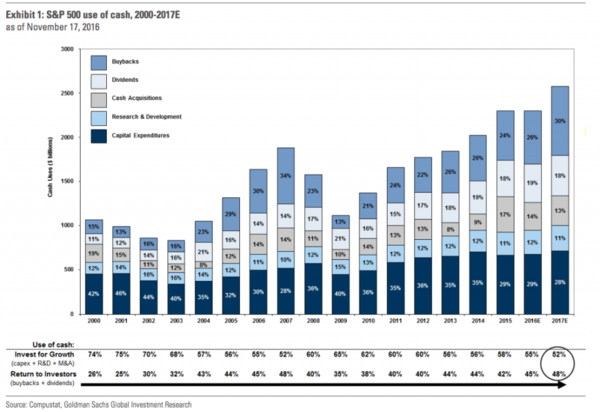

Como era de esperarse, sin embargo, los ricos usaron este dinero para volverse mas ricos, y ante las modestas perspectivas de ganancia en la actividad productiva, se volcaron masivamente a la especulación. El gráfico 4 muestra la evolución del uso del dinero entre las empresas del S&P500. El gasto en inversiones de capital pasó del 42% en el 2000 al 28% en 2017. Mientras el gasto vinculado a retornos para los inversores (compra de las propias acciones y dividendos para los accionistas) paso del 26 al 48% en mismo periodo.

Gráfico 4. S&P 500 uso de dinero, 2000 – 2017. Citado en Toussaint, Eric:La montaña deudas privadas estará en el corazón de la próxima crisis financiera.

Un tercer elemento de “estimulo” fueron los enormes recortes impositivos a los más ricos realizados por el gobierno de Donald Trump. A través del “Tax Cuts and Jobs Act”, aprobado en diciembre de 2017, redujeron los impuestos corporativos del 35% al 21%. El crecimiento de las inversiones y su efecto multiplicador sobre el conjunto de la economía nunca llego. Un estudio del FMI del año 2019 muestra que menos del 20% de los ingresos extra obtenidos a partir de los recortes se utilizó en inversiones de capital, mientras alrededor del 80% se usó para compra de las propias acciones y dividendos de accionistas.[2] Un efecto que si se hizo sentir ha sido un aumento en la desigualdad. Un estudio del Congreso de EEUU que mide el efecto de los recortes impositivos sobre los ingresos proyecta, para el periodo 2016 – 2021, que éstos producirán una caída del 0.2% en los ingresos del 20% mas pobre, mientras el 1% mas rico verá incrementar sus ingresos 0.9%.[3]

Así, uno de los elementos centrales de la fragilidad de la configuración actual de la economía es la enorme deuda corporativa. La caída de la bolsa puede afectar fuertemente la capacidad de pago de estas empresas, desatando una oleada de repercusiones tanto para las propias empresas como sus acreedores. De esta manera, alimentando la posibilidad de una recesión.

En un reciente articulo Eric Toussaint afirma

que “Todos los factores para una nueva crisis financiera estaban y están

presentes y juntos desde hace varios años, al menos desde 2017-2018. Cuando la

atmósfera está saturada de materias inflamables, en cualquier momento, una

chispa puede provocar una explosión financiera.”[4]

Es probable que estemos viviendo los primeros momentos de una nueva crisis y recesión.

Cuando esta se desenvuelve, es fundamental no perder de vista sus causas, para

que los responsables no puedan seguir acumulando ocultos detrás de un virus o

del precio del barril de petróleo.

[1] Roberts, Michael: Marx’s law of profitability at SOAS. Disponible en https://thenextrecession.wordpress.com/2020/02/27/marxs-law-of-profitability-at-soas/

[2] IMF Working Paper, U.S. Investment Since the Tax Cuts and Jobs Act of 2017, disponible en https://www.imf.org/en/Publications/WP/Issues/2019/05/31/U-S-46942

[3] Congress of the United States, Congressional Budget Office, Proyected Change in the distribiution of household income. Diciembre 2019, disponible en https://www.cbo.gov/system/files/2019-12/55941-CBO-Household-Income.pdf

[4] Toussaint, Eric. No, el coronavirus no es el responsable de las caídas en las bolsas. Disponible en https://www.cadtm.org/No-el-coronavirus-no-es-responsable-de-las-caidas-en-las-bolsas