Por Carlos Carcione

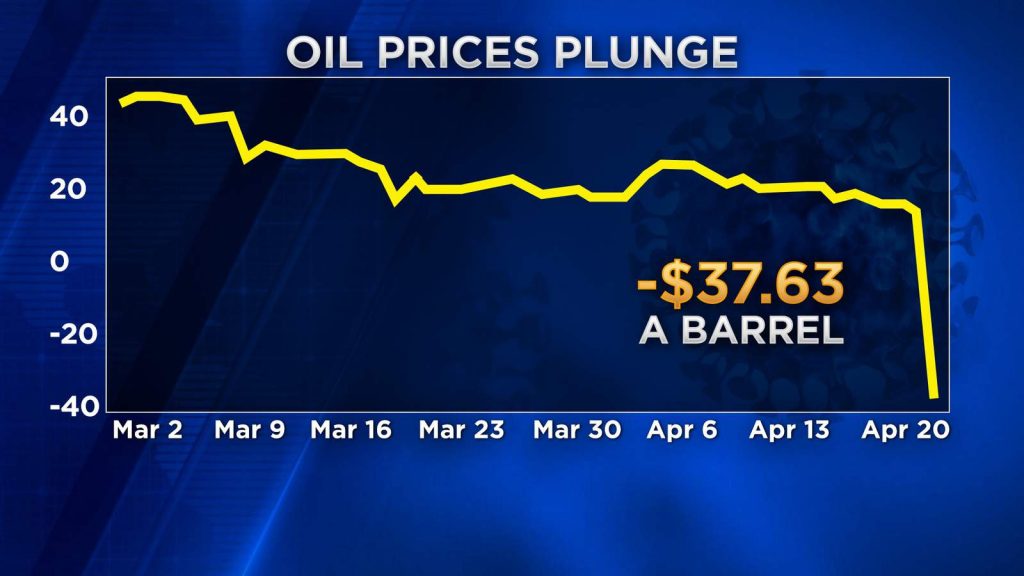

La caída histórica de los precios del petróleo, llegando a cotizase en montos negativos para las transacciones que deben concretarse en mayo, sólo puede leerse en el contexto de crisis mundial del capitalismo. La pandemia de COVID19 actúa como telón de fondo y catalizador de un colapso del sistema que viene desarrollándose desde el 9 de marzo pasado y que es la expresión de más de una década de declinación pronunciada del capitalismo, que comenzó con el crack de 2008. Y que ya antes del estallido del brote del virus, tenía en el horizonte la posibilidad inmediata de crisis.

La superproducción en relación a una economía mundial que venía en declive y en la que se produce un frenazo, se pone de manifiesto a través del límite físico para el almacenamiento del producto que se da por el derrumbe de la demanda. Este hecho lleva a que 160 millones de barriles, 60% más que el consumo diario mundial, se encontraban en la semana de la mayor caída del precio, almacenados en barcos tanqueros que están navegando sin la certeza de poder descargar el producto. Otra causa inmediata es la especulación que llevó al estallido de la burbuja en el mercado financiero de futuros del crudo. Pero esta sucesión de colapsos se producen como parte de la onda expansiva de la profundidad de la crisis en desarrollo. Una crisis que el FMI llama depresión, para señalar que el colapso actual es superior al del 2008 al que llamó Gran Recesión, y que es solo comparable con la crisis de los años ’30 del siglo pasado que derivó en la Segunda Guerra Mundial. La importancia de establecer el contexto de este colapso está relacionada con la perspectiva que tienen los precios, pero sobre todo la industria petrolera de conjunto.

Al segundo día de precios negativos en Estados Unidos, Trump se vio obligado a anunciar que jamás dejaría caer la industria petrolera (norte) americana, que es de las más afectadas, desde que en febrero la OPEP y Rusia rompieron un acuerdo que mantenían desde hace años por el cual regulaban los precios petroleros manejando la producción del crudo. Pero la situación económica mundial es tan incierta que inclusive la rebaja de 15 millones de barriles diarios en la producción acordada a principios de abril, o el anuncio de comprar 75 millones de barriles para la reserva estratégica de Estados Unidos, no provocaron el efecto esperado de sostener los precios. La promesa de Trump de apoyar a la gran industria de su país podría resultar en otro fiasco. El grave problema planteado para el sistema es que la quiebra de la industria petrolera arrastraría tras de sí a una parte del sistema bancario, lo que tendría un efecto multiplicador. La deuda hoy de esas empresas es Estados Unidos es de más de 100.000 millones de dólares. Una deuda que ya era de difícil cumplimiento con el precio de 60 dólares el barril de principios de año y que en las condiciones actuales se ha vuelto directamente impagable. Así las cosas, es probable que la volatilidad de los precios esté actuando como un martillo que va demoliendo las bases de la industria tal como se la conoce en la actualidad. Es parte de la reconfiguración de un mundo económico que está en pleno proceso de derrumbe.

Precio, guerra de mercados, bloqueo económico y especulación

Al contrario de lo que sostienen los economistas liberales cuando afirman que este fenómeno de los precios petroleros demostraría el fracaso de Marx, dejando al desnudo toda su olímpica ignorancia, esta oscilación abrupta confirma una vez más toda la crítica de la economía política desarrollada por Marx y Engels. Además del movimiento de la oferta excesiva y la caída abrupta de la demanda, que en este caso es uno de los ángulos principales para analizar la actual crisis, la extracción petrolera está más asociada a la renta minera como parte de la renta de la tierra que a la ley del valor trabajo. La extracción petrolera se relaciona más con la renta diferencial extraordinaria que obtiene de las tierras más productivas, que por la ganancia lograda por la explotación del trabajo. Esta renta extraordinaria hace posible que los precios puedan manipularse sobre la base de los costos de extracción. Y las variaciones de estos costos son enormes. Por ejemplo: Arabia Saudita extrae a un costo que va de un rango de entre 4 y 8 dólares el barril, mientras que para extraer un barril en Rusia el costo es superior a los 18 dólares y el petróleo de esquisto, el que se extrae en Estados Unidos, o en Vaca Muerta por ejemplo, ronda los 48 dólares el barril de costo. Y estas diferencias no tienen que ver con la cantidad de trabajo ni los niveles salariales, ni el tipo de tecnología utilizada solamente, sino fundamentalmente con el nivel de productividad de las tierras de donde se extrae, de esta renta extraordinaria es de donde surge la capacidad de la manipulación de los precios.

Esto es lo que explica en última instancia la decisión que tomó la OPEP + (Arabia Saudita y Rusia fundamentalmente) que dejo liberado a cada país productor y llevo a una ofensiva de Arabia Saudita de reducir sus precios en febrero aproximadamente a la mitad de lo que estaban días antes para presionar a Rusia a reducir la producción. Y desató el derrumbe al coincidir y disparar los elementos de crack económico que ya venían anunciándose. La ruptura del acuerdo tenía de trasfondo una disputa de mercados en el contexto de que también se venía reduciendo el consumo por los elementos de desaceleración de la economía productiva que desde finales de 2019 venía anunciando el inicio de una recesión global.

El bloqueo de gran parte de la economía que se da en la actualidad para contener el virus, con distintas formas de confinamiento, empujó todavía más la restricción del consumo de energía y sobre todo de petróleo. La reducción de casi el 80% de los vuelos y en menor medida pero que agrega otra restricción al consumo, la reducción de la circulación de automóviles por las mismas razones, todo esto fue colapsando toda la cadena de producción, refinación y distribución del crudo, desbordando la capacidad de almacenamiento del crudo, colocando al sistema de refinación al borde del cierre y amenazando la capacidad de almacenamiento. Convirtiéndose de hecho en un nuevo punto agudo de la crisis económica mundial.

Como señalamos más arriba uno de los datos más significativos del actual derrumbe de los precios del barril se expresó en el mercado especulativo de futuros, es decir los papeles con los que se negocia la producción petrolera que debe ser entregada en un tiempo futuro. Allí al cierre de las operaciones para las compras concretas en el mes de mayo llegó cotizar menos 37 dólares. Es decir que el que vendía el papel transfiriendo su titularidad debía además entregar casi 40 dólares por barril al comprador. Pero esta no es la única práctica especulativa, la más peligrosa está encerrada en la deuda de las empresas petroleras. La quiebra masiva que se espera en la industria podría arrastrar a una parte del sistema bancario ya que esa deuda está garantizada por las reservas que deberían extraer esas empresas. Es decir por petróleo que aún está debajo de la tierra o en la roca madre y que a los precios actuales nadie querrá extraer.

Limite físico para el almacenamiento de la oferta excesiva, guerra de mercados, caída del consumo, bloqueo económico productivo y especulación financiera y bancaría, están en la base del actual colapso petrolero. Pero el trasfondo es la crisis estructural del sistema capitalista y su modo de producción.

El colapso petrolero extrema el desorden de la economía mundial

Para los analistas del sistema, el petróleo es la “sangre” del capitalismo. Para los pueblos que sufren en carne propia los desastres que han causado los más de dos siglos de explotación petrolera, es como lo llamó el “Padre de la OPEP”, el venezolano Juan Pérez Alfonso, “El excremento del diablo”. Sea cuál sea la metáfora que se use para nombrarlo, el petróleo ha sido una clave del desarrollo del capitalismo moderno. Si la que estamos atravesando fuera solamente una crisis de sobreproducción, que lo es también, una reducción drástica de la producción podría estabilizar los precios. Pero en el contexto económico actual, en el que la crisis está en pleno desarrollo y de la que no se ve el final, donde ya han fracasado las políticas monetarias y fiscales similares a las que frenaron el derrumbe en 2008, es poco probable que una medida aislada en esta rama, pueda ordenar el escenario de colapso por el que estamos transitando. La crisis, más que a un nudo problemático específico, se parece a un campo minado, donde a cada paso puede estallar un nuevo crack. La famosa “mano invisible del mercado” puede mantener un relativo equilibrio del sistema en la medida que éste esté ordenado. Pero cuando las leyes del propio mercado no ordenan ni equilibran, cuando el capitalismo muestra con toda fuerza una de sus principales característica que es la anarquía de la producción. Cuándo lo que domina es el sálvese quién pueda entre los capitalistas, y cuando el Estado burgués debe asumir por la propia contundencia de la crisis el intento de poner orden en el sistema, todas las certezas de este se desintegran. La reconfiguración del mundo actual que muchos pronostican para luego de la pandemia ya está sucediendo en su fase destructiva del viejo mundo. En este contexto el colapso petrolero actúa como una fuerza entrópica que profundiza exponencialmente el desorden de conjunto del sistema.