The new scandal over the investigation into big tax evaders highlights the greed and injustice of the capitalist system.

By Rubén Tzanoff

Evading taxes is a common practice among the rich and powerful. It is facilitated by governments and institutions. While the rich evade taxes on their luxuries, the poor pay taxes for food and work. They are not isolated events, but common practices, typical of the capitalist system.

A revealing investigation

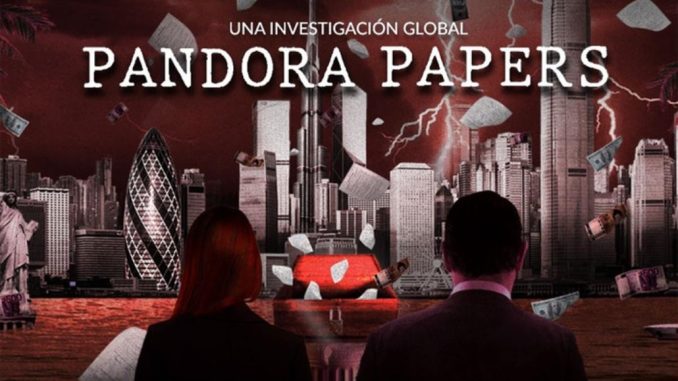

Every so often there are leaks of information that expose how capitalism functions. Not long ago it was the Panama Papers and WikiLeaks. Now it is the Pandora Papers, the name by which the investigation carried out by the International Consortium of Investigative Journalism was made known. The published documents make explicit the hidden wealth and the mechanisms of offshore companies to evade taxes through a network of shell companies.

The rich and famous

The list includes the financial maneuvers of: 35 political leaders and former heads of state, 330 senior political officials, 91 countries and many world-renowned figures. Among many others: King Abdullah of Jordan, former British Prime Minister Tony Blair, people close Russian President Vladimir Putin, Czech Prime Minister, Andrej Babis; presidents: Volodímir Zelenski (Ukraine), Sebastián Piñera (Chile) and Luis Abinader (Dominican Republic); former presidents: Andrés Pastrana and César Gaviria (Colombia) and people close to former presidents of Argentian Néstor Kirchner and Mauricio Macri.

Some of the famous people mentioned are: Julio Iglesias, Shakira and Pep Guardiola. Also on the list are Corinna Larsen, former lover of emeritus king of Spain Juan Carlos I, and Sanginés-Krause, the businessman and friend who financed credit cards used by members of the royal family.

Cynical formality

Since 2017, the European Union has published a black list of tax havens. It is a formality that has just shown its uselessness with the latest update, released a few days ago. In it they left out the Seychelles, Anguilla and Dominica. And they did not include the British Virgin Islands. In other words, the tax havens that occupy prominent places in the Pandora Papers are not listed. Power does not prevent evasion, it facilitates it with cynical formality.

Penalized and favored

Governments and their tax agencies penalize working people with regressive tax burdens, such as the VAT and income taxes on wages. That is, they increase the prices of elementary consumer goods and charge for exercising the right to work. What we need to do is eliminate both those levies and collect progressive taxes on great fortunes.

On the other hand, off shore companies are legal, provided that their activities are declared before the tax authorities of the resident’s country. From the halls of power, legal mechanisms are facilitated to carry out the evasion. They create a financial safety valve to favor the rich in such a way that they maintain their privileges and only pay crumbs.

It’s capitalism

When businessmen and the rich evade, they take into their pockets the money that states should allocate for wages, health care, housing and public education. And they will continue to do so. Always with the complicity of the authorities, whose high-ranking officials are also evaders.

Despite the propaganda announcements about alleged controls, transparency does not appear. Although the names on the lists change, the opaque essence of capitalism remains. A system that cannot be humanized, honest, or fair. That is why we must defeat it with a socialist revolution and build a completely different society, without exploiters or corrupt people. Based on justice and solidarity, where the workers and the people debate and decide everything.

You may be interested in AUKUS makes workers pay for war with China